In the realm of domain name investments, data often uncovers hidden truths. Recently, domain investor George Kirikos once again showcased the fascination of domain name transactions through his in-depth data analysis. Rocket.com, a domain name registered in 1991, was recently sold for $14 million, marking the fourth most expensive domain name transaction ever recorded.

- Transaction Details

By interpreting the seller’s recent financial documents, Kirikos discovered crucial sales data. During a full-text search on the U.S. Securities and Exchange Commission (SEC) website, Kirikos found a passage on page 29 of the financial report stating, “For the quarter and nine months ended September 27, 2024, including $14 million of revenue after deducting expenses related to the sale of domain names.” This discovery revealed the transaction price of Rocket.com, although the actual amount may have been higher.

- Transaction Ranking

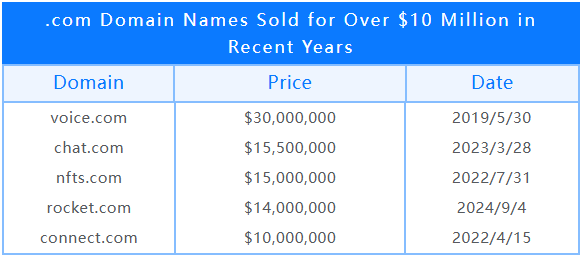

Based on recorded transactions, the sale price of Rocket.com surpassed Sex.com, which was sold for 13million,butitstilllagsbehindseveralotherhighertransactions,includingVoice.com(30 million), 360.com (17million),andNFTs.com(15 million). Kirikos’ take on this transaction is that, despite the high price, he believes it was still a “too low” offer, especially considering the market capitalization of the buyer, a major financial institution.

- Expert Insights

Despite Kirikos’ perspective, Andrew Miller, the lead broker of the transaction, expressed caution. He declined to disclose the buyer’s specific information and the transaction amount, emphasizing that market capitalization alone cannot fully determine the final price of a domain name. Miller pointed out that many companies with huge market capitalizations do not pay “on-demand” prices for domain names. For those who have not experienced large transactions, simply stating that the price is too low is inaccurate.

Miller said, “Just because a company has a huge market capitalization or cash balance sheet does not mean they will pay the highest price for the asset.” In such cases, many factors can influence the buyer’s decision-making.

While the details of the Rocket.com transaction remain confidential, it is undeniable that the seller obtained a net profit of $14 million from it. Thanks again to George Kirikos, who, with his rigorous research methods, revealed important data and trends in domain name sales. The Rocket.com transaction not only set a new market record but also provided profound insights for domain investors, further proving that the value of premium domain names in the digital economy should not be underestimated.